Annual Gift Tax Exclusion 2024 Chart Printable

Annual Gift Tax Exclusion 2024 Chart Printable. The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2024 due to inflation. The irs adjusts the threshold each year to account for inflation.

The annual gift tax exclusion level will increase from $17,000 per person in 2023 to $18,000 per person in 2024, in tandem with the significant adjustments in the. Annual federal gift tax exclusion.

The 2024 Annual Gift Tax Exclusion Is $18,000.

A married couple filing jointly can double this.

The Irs Adjusts The Threshold Each Year To Account For Inflation.

In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

The Value Of Gifts Made To Any Person (Excluding Gifts Of Future Interests In Property) That Are Not Included In The Total.

Images References :

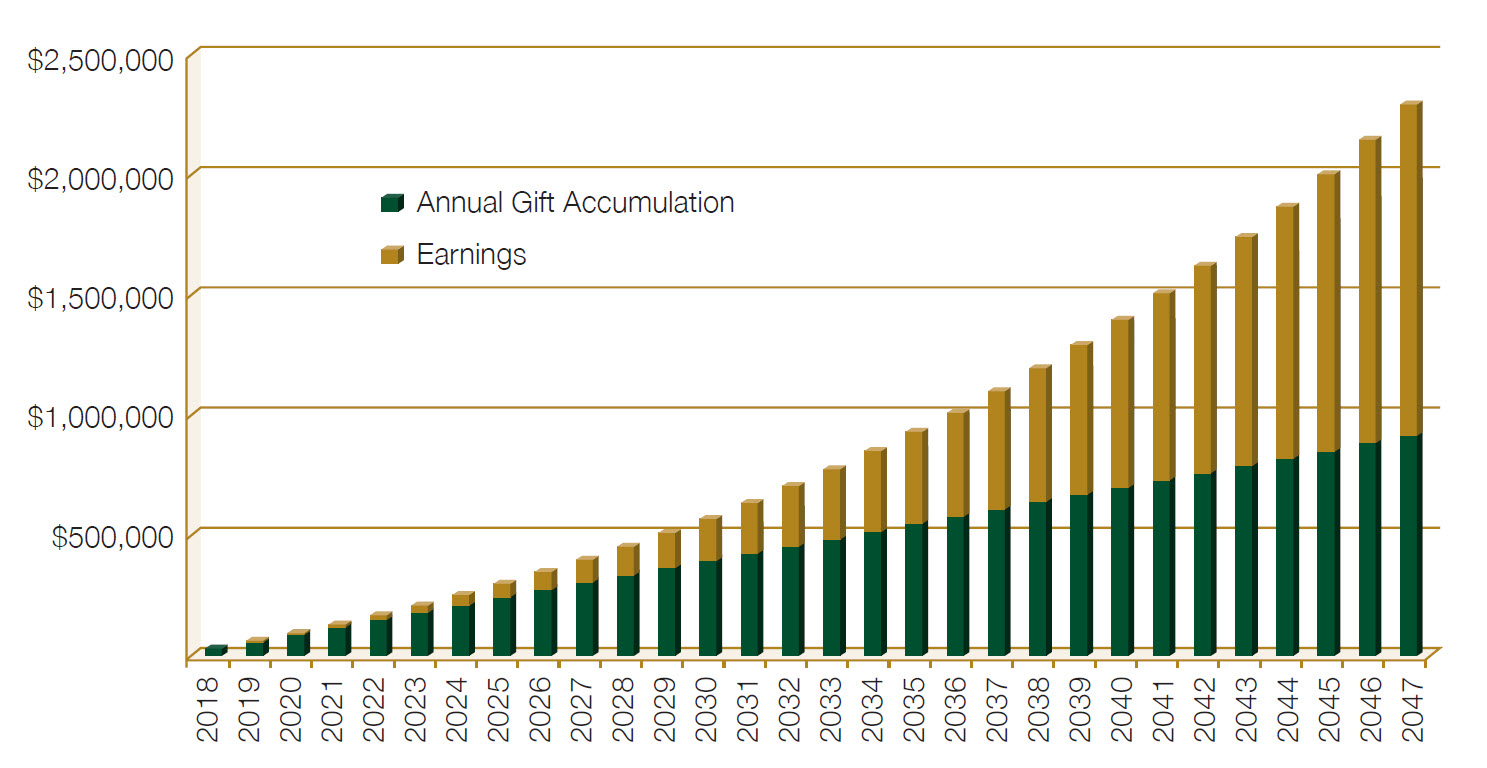

Source: www.firstrepublic.com

Source: www.firstrepublic.com

Annual Gift Tax Exclusions First Republic Bank, The annual gift tax exclusion level will increase from $17,000 per person in 2023 to $18,000 per person in 2024, in tandem with the significant adjustments in the. No need to sweat the federal gift tax.

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group The Annual Gift Tax Exemption What You Need To Know, Gift tax exemption for 2024. No need to sweat the federal gift tax.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Married couples filing jointly can take advantage of. For the year 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Starting on january 1, 2024, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023). The annual gift tax exclusion level will increase from $17,000 per person in 2023 to $18,000 per person in 2024, in tandem with the significant adjustments in the.

Source: tobeqphillida.pages.dev

Source: tobeqphillida.pages.dev

What Is The 2024 Gift Tax Exclusion Aila Lorena, This means that you can give up to $13.61 million in gifts in your. The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2024 due to inflation.

Source: elderlawms.com

Source: elderlawms.com

2024 Annual Gift and Estate Tax Exemption Adjustments Courtney Elder, A married couple filing jointly can double this. The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2024 due to inflation.

Source: roseelderlaw.com

Source: roseelderlaw.com

2024 Annual Gift and Estate Tax Exemption Adjustments Rose Elder Law, This change presents a valuable. In 2023, the annual gift tax limit was $17,000.

Source: elenabmariel.pages.dev

Source: elenabmariel.pages.dev

2024 Lifetime Gift Exclusion Filide Sybila, Starting on january 1, 2024, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023). The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2024 due to inflation.

Source: southpointep.com

Source: southpointep.com

2024 Annual Gift and Estate Tax Exemption Adjustments — Southpoint, The annual gift tax exclusion level will increase from $17,000 per person in 2023 to $18,000 per person in 2024, in tandem with the significant adjustments in the. Married couples filing jointly can take advantage of.

Source: www.taxuni.com

Source: www.taxuni.com

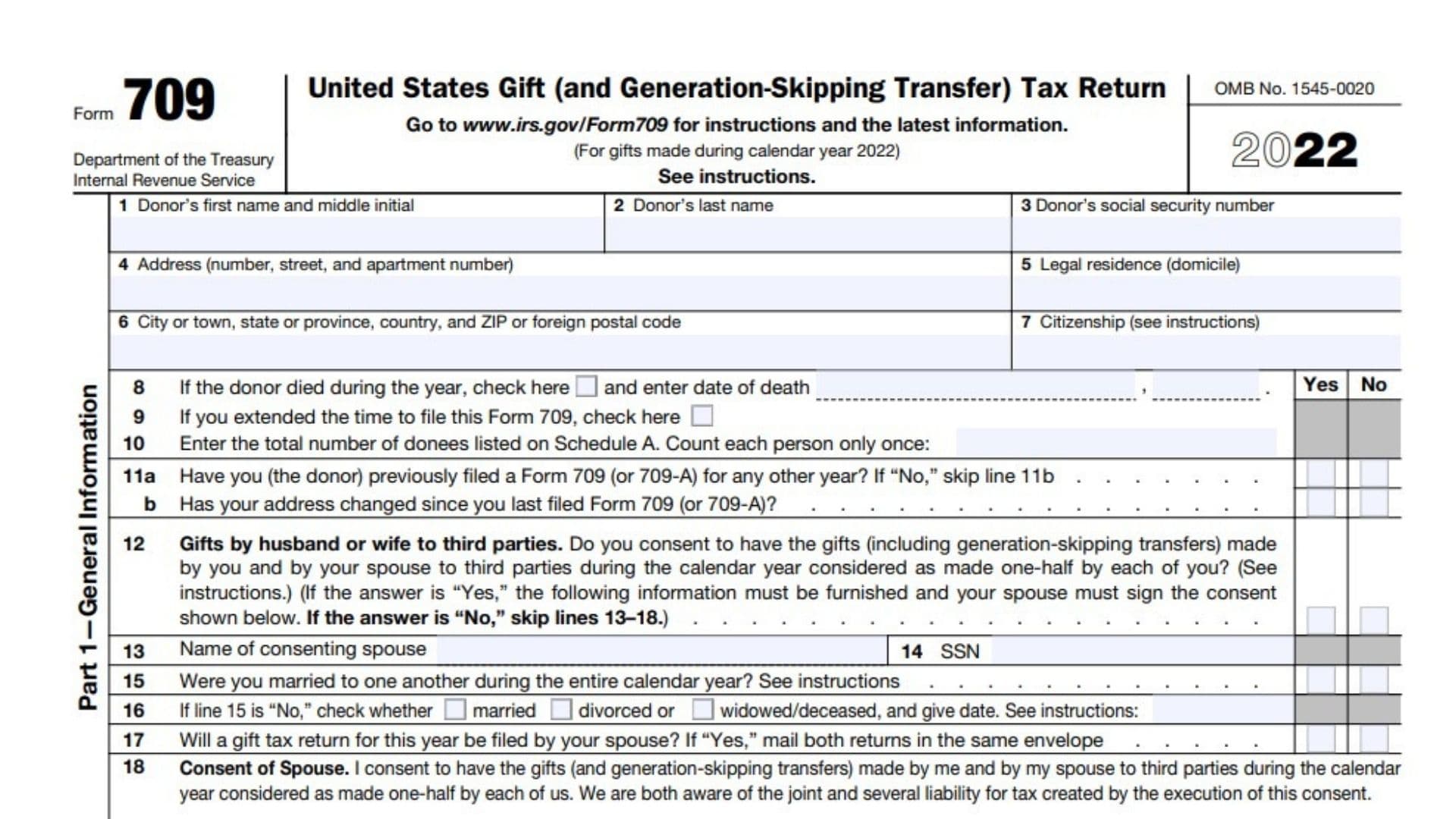

Annual Gift Tax Exclusion, Annual federal gift tax exclusion. The irs has announced an update to the annual gift tax exclusion, raising the limit from $17,000 in 2023 to $18,000 for 2024.

The Exclusion Will Be $18,000 Per.

The irs adjusts the threshold each year to account for inflation.

Starting January 1, 2024, The Exclusion For Gifts Will Be $18,000 Per Recipient, A Notable Increase From $17,000 In 2023.

As of 2024, the annual exclusion is $18,000.