North Carolina State Income Tax 2025

North Carolina State Income Tax 2025. For more information about the income tax in these states, visit the north carolina and. You may deduct from federal adjusted gross income either the nc standard deduction or nc itemized deductions.

The personal income tax rate for tax years beginning in 2021 is 5.25%. For more information about the income tax in these states, visit the north carolina and.

Under Hb 259, Enacted On October 3, 2023, Without The Signature Of Governor.

North carolina state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents.

Represents Smart Investments And Supports That Best Achieve Our Goals.

In most cases, your state income tax will be less if you take the.

North Carolina State Income Tax 2025 Images References :

Source: taxedright.com

Source: taxedright.com

North Carolina State Taxes Taxed Right, North carolina state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. How to pay your individual income taxes tutorial.

Source: ncbudget.org

Source: ncbudget.org

NC Budget & Tax Center, North carolina policymakers should continue making the state’s income tax rates more competitive and simultaneously prioritize for reform the areas of the tax code. July 6, 2024, 3:17 p.m.

Source: www.statepedia.org

Source: www.statepedia.org

North Carolina Individual Tax Complete Guide, The state’s income tax will drop to 4.5% in 2024, from 4.6%, then to 4.25% in 2025 and 3.99% in 2026. The personal income tax rate for tax years beginning in 2021 is 5.25%.

Source: www.youtube.com

Source: www.youtube.com

PAYING NORTH CAROLINA STATE TAXES YouTube, North carolina law gradually reduces personal income tax rates starting in 2024. North carolina has a flat income tax rate, which means residents pay the same individual income tax rate regardless of income level.

Source: www.carolinajournal.com

Source: www.carolinajournal.com

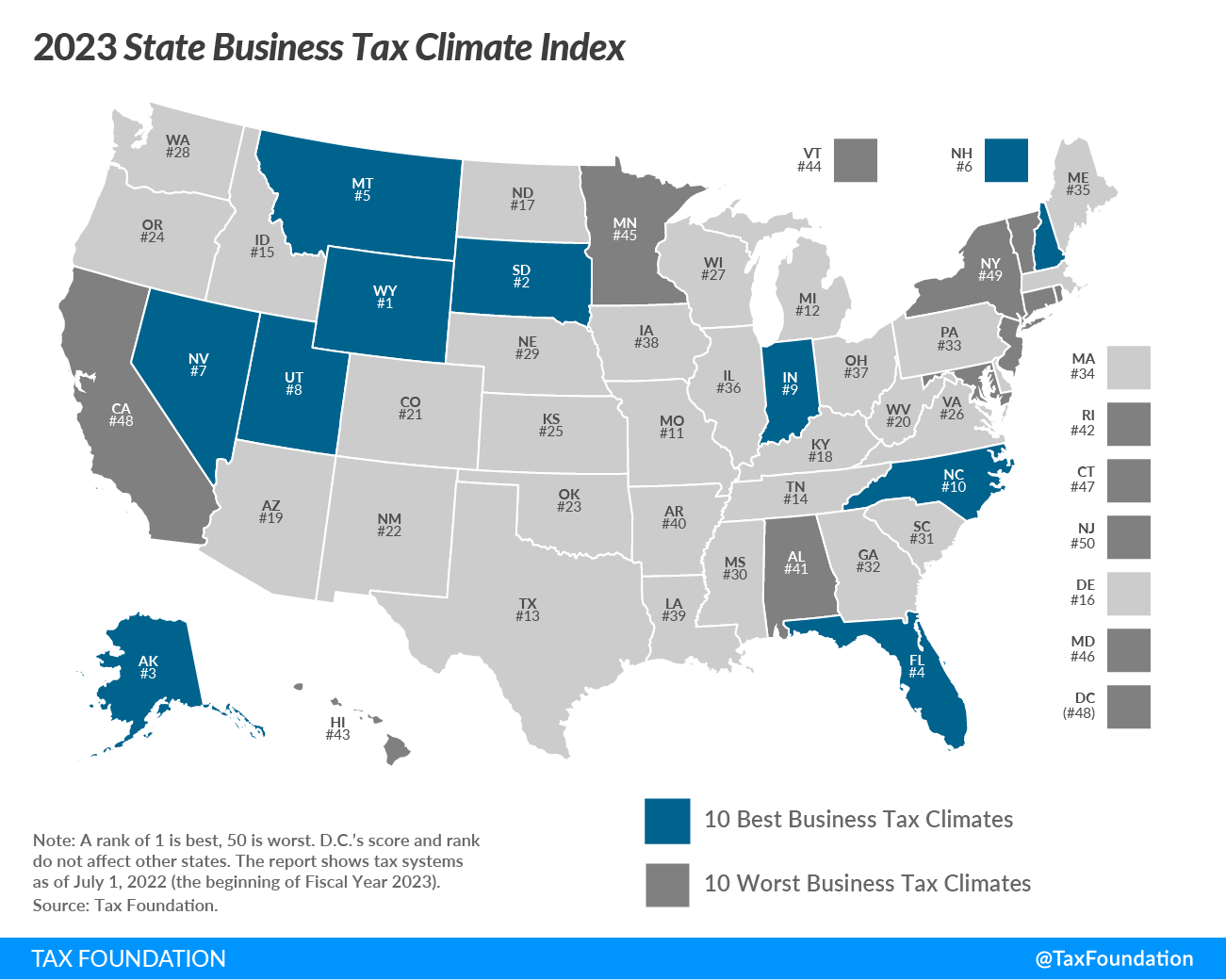

North Carolina ranks 10th in nation for positive tax climate, North carolina has a flat income tax rate, which means residents pay the same individual income tax rate regardless of income level. This tool compares the tax brackets for single individuals in each state.

Source: pulse.ncpolicywatch.org

Source: pulse.ncpolicywatch.org

An Earned Tax Credit for North Carolina is just common sense, Represents smart investments and supports that best achieve our goals. North carolina now has a flat state income tax rate of 4.75%.

Source: brokeasshome.com

Source: brokeasshome.com

nc tax tables, You must send payment for taxes in north carolina for the fiscal year 2024 by april 15, 2025. For taxable years after 2025, the north carolina individual income tax rate is 3.99%.

Source: statetaxesnteomo.blogspot.com

Source: statetaxesnteomo.blogspot.com

State Taxes State Taxes For North Carolina, After much debate, the budget includes accelerated individual income tax cuts, changes to the corporate franchise tax, a new ride sharing tax, new and modified. The 2023 state individual income tax rate is 4.75%, which is down from 4.99% in 2022.

Source: www.fusiontaxes.com

Source: www.fusiontaxes.com

Multistate Taxes Expanding into North Carolina, 105 amends several tax provisions for north carolina personal income taxpayers. Effective for taxable years beginning on or after january 1, 2024, the personal income tax rate is gradually lowered from the current.

Source: www.taxuni.com

Source: www.taxuni.com

North Carolina State Tax 2023 2024, North carolina law gradually reduces personal income tax rates starting in 2024. Getting started with your state income taxes.

North Carolina Currently Has The 35 Th Highest State Income Tax Rate For.

The personal income tax rate for tax years beginning in 2021 is 5.25%.

North Carolina Law Gradually Reduces Personal Income Tax Rates Starting In 2024.

Getting started with your state income taxes.

Posted in 2025